Selling Price Per Unit Formula

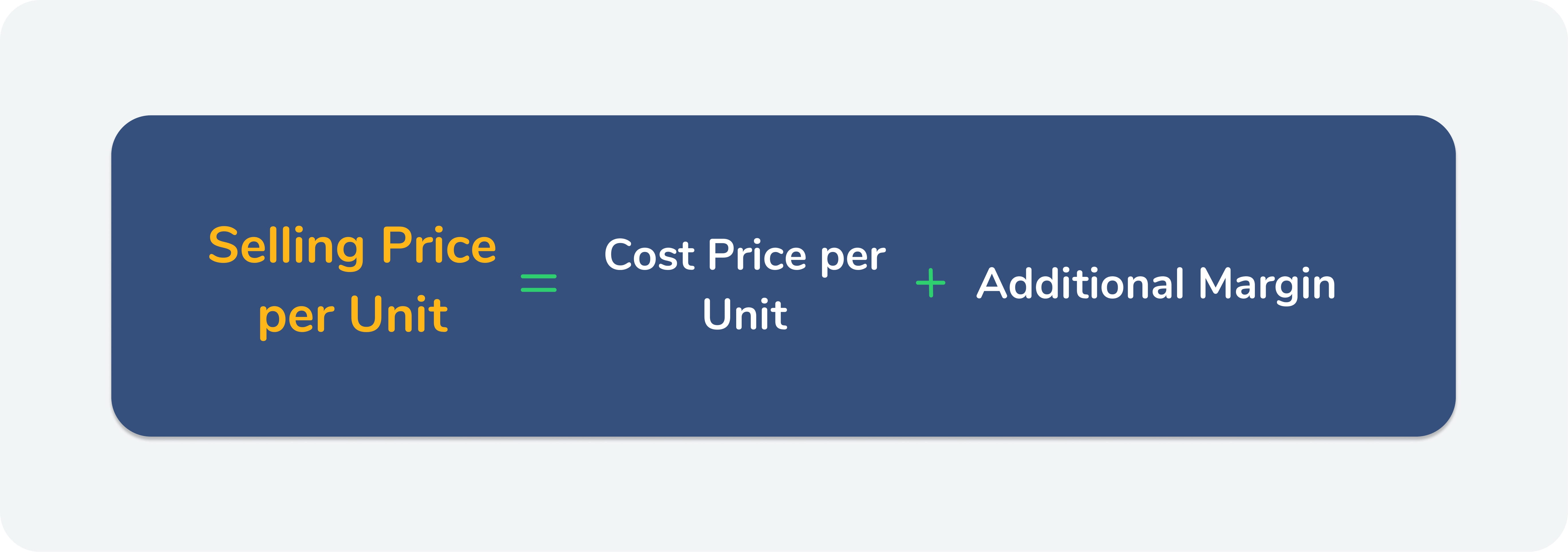

The following is the cost-plus pricing formula. The formula for profit can be derived by using the following steps.

Markup Percentage Formula Calculator Excel Template

Break even Sales Price 37500075000.

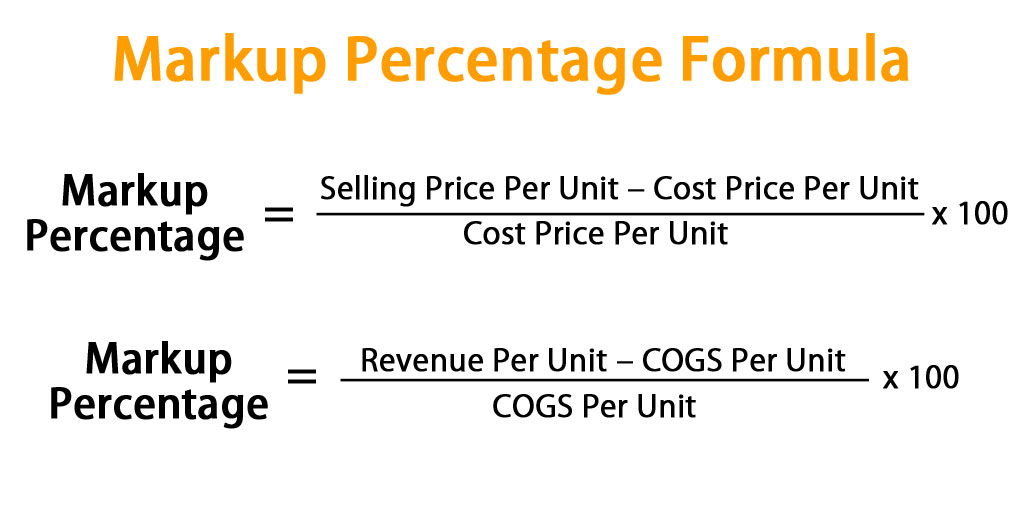

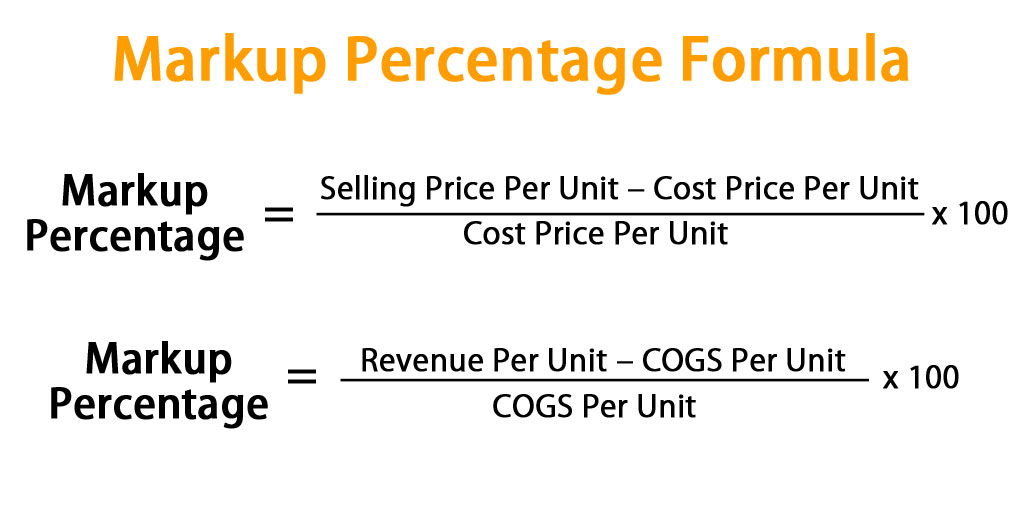

. Now divide the sales revenue and the cost of goods sold by the units sold to get the average selling price per unit and the average cost per unit respectively. A fixed cost does not change based on the number of products that are created. Markup Percentage S e l l i n g P r i c e U n i t C o s t U n i t C o s t 100.

The business then decides on an. Average selling price per unit. Thus the selling price per unit formula to find the price per unit from the income statement divide sales by the number of units or quantity sold to identify the price per unit.

Let us take the example of a toy-making company that sold 10 million toys during the year. So the price per unit of the product is 216. Every product costs money to create and these costs can be either fixed or variable costs.

The cost per unit is. In the following month ABC produces 5000 units at a variable cost of. The selling price is 70 while the unit cost is 40.

For example if your products cost per unit is 50 your breakeven price is 50 and therefore you must sell each unit of your product for more than 50 to make money. Therefore the formula for break-even point BEP in units can be expanded as below Break Even Point in Units Fixed. Price per Unit Cost per Unit Profit Requirement.

Break Even Quantity Fixed Costs Sales Price per Unit Variable Cost Per Unit Where. The accountant finds the brands total costs and multiplies this value by the brands desired profit margin of 40 to get a total desired profit of 26040 per month. Sales Formula Example 1.

Out of the total 3 million toys were sold at an average selling price. Price Cost per unit 1 Percentage markup Lets take an example. Target cost Selling price x 1 Gross margin In the above example the calculation is as follows.

Markup in very simple terms is basically the difference between the selling price per unit of the product and the cost per unit associated in making that product. A very simple example would be if you have a fully staffed factory and that facility only produced one individual unit of product. Selling price formula.

Calculate the variable cost per unit. The corporate accountant has calculated the following costs. Price per Unit 1836 216.

Follow the steps below to find the selling price per unit. However a rule of thumb is to add a 25 mark-up a technique known as cost-plus or mark-up pricing. In most cases the production cost serves as a guide to determine the final selling price of a product or service.

Break even Sales Price 37500050000 units 49 5650. A clothing company reports its production costs as. Let us use the formula below to solve the problem.

Firstly determine the revenue or sales of the company and it is easily available as a line item in the income. A key concept in this formula is the fixed- cost per-unit of sales. Your selling price formula will look something like this.

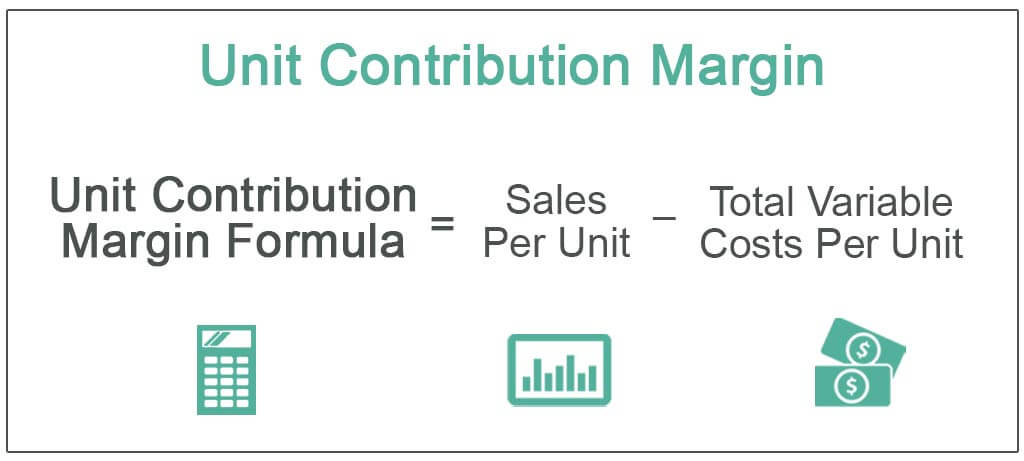

Contribution margin Selling price per unit Variable cost per unit. Target cost Selling price x 1 - Gross margin Target cost 60 x. So basically it is the.

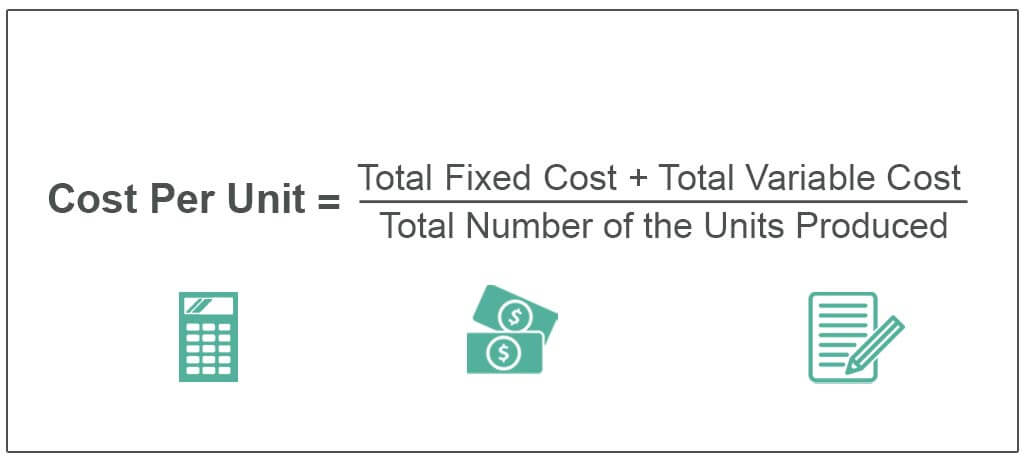

30000 Fixed costs 50000 variable costs 10000 units 8 cost per unit. The formula for break even analysis is as follows. Fixed Costs are costs that do not.

Unit Contribution Margin Meaning Formula How To Calculate

Cost Per Unit Definition Examples How To Calculate

How To Calculate Variable Cost Per Unit Double Entry Bookkeeping

Selling Price Formula And Calculation Wise Formerly Transferwise

0 Response to "Selling Price Per Unit Formula"

Post a Comment